REVIEW

The development of technology is currently increasing rapidly. Especially in trading and exchange systems that have moved using blockchain technology. Since 2008 the emergence of blockchain has become a hot topic of conversation in many circles, coupled with the emergence of digital exchange media in the form of Cryptocurrency (digital currency). Cryptocurrency is becoming a new medium of exchange. Along with its development, manyIntroduction

The development of technology is currently increasing rapidly. Especially in trading and exchange systems that have moved using blockchain technology. Since 2008 the emergence of blockchain has become a hot topic of conversation in many circles, coupled with the emergence of digital exchange media in the form of Cryptocurrency (digital currency). Cryptocurrency is becoming a new medium of exchange. Along with its development, many platforms continue to emerge by creating digital coins that use the blockchain system as a medium or market for all types of crypto around the world. And this time I want to present a project that has a bright future, namely the Rain.Credit Project. Of course, the presence of the Rain.Credit project can change everything, especially for investors and so onme of the partners involved in it. This project is very profitable for investment, so don’t ever waste this golden opportunity.

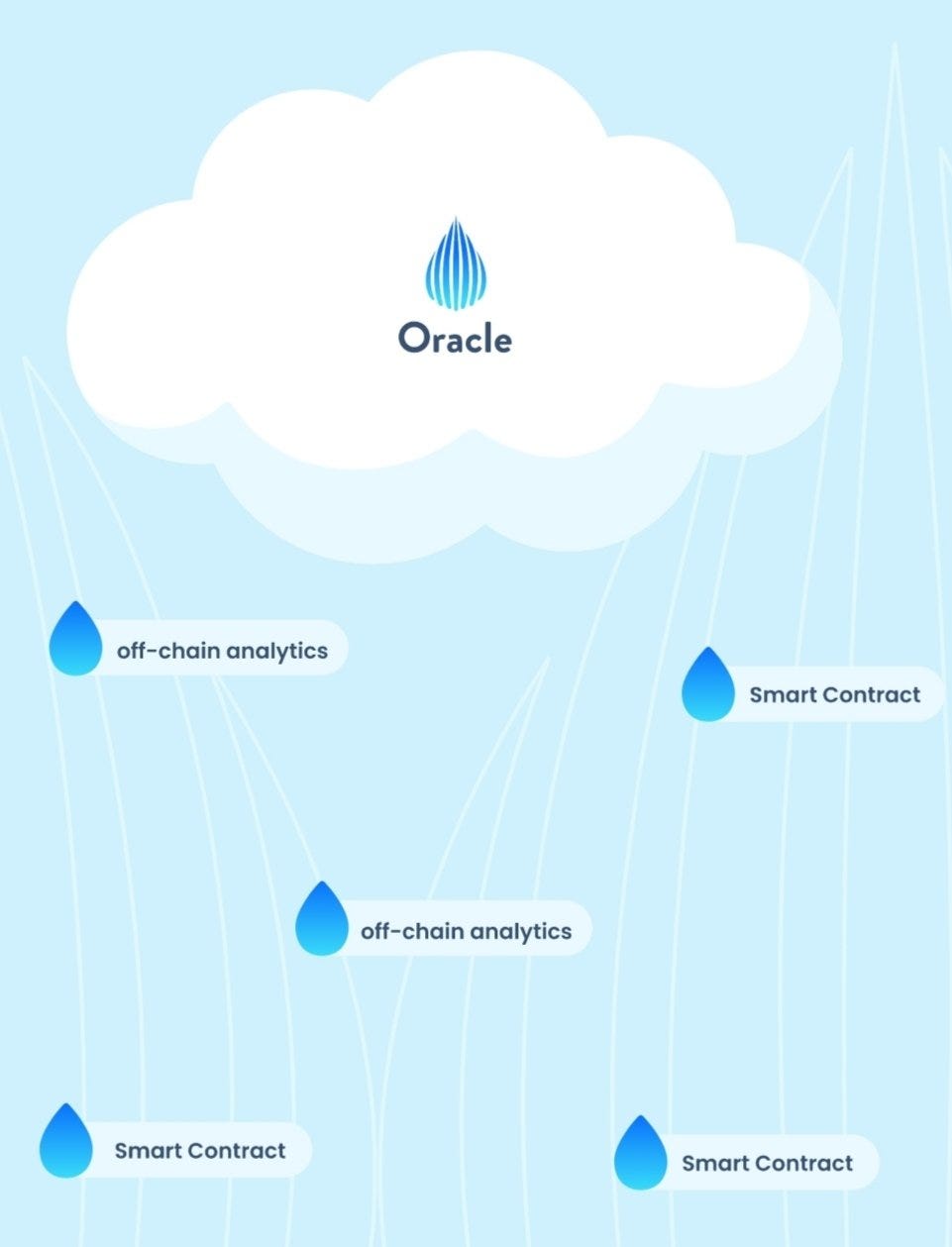

Rain.Credit is a BEP20 token on the Binance Smart Chain that acts as an Oracle Aggregator non-custodial Off-Chain Data analyzer that assigns a short Credit rating to a user’s address. This credit rating has a function to provide a good collateral factor for all lenders and is also useful for borrowers of digital assets on the rain platform. rain.Credit is based on current decentralized lending platforms and protocols, but with changes to bring more innovative designs and experiences.

what makes us so unique is how we will use Off-Chain Aggregate analysis to help reduce investors’ exposure as they begin to interact with our ecosystem.

The formula for determining the amount of $ Rain tokens to be lent is as follows:

HUJAN = AMOUNT TO BEND + HISTORY OF THE TRANSACTION / AMOUNT TO BE SECURED

SOME OF THE MAIN FEATURES THAT WILL BE AVAILABLE ARE:

INTEGRATION WITH EXTERNAL DATA PROVIDERS AND DIRECTORS

BLACK DECENTRALIZED ACCOUNT TRACKER

SMART CONTRACT ANALYSIS

MEASUREMENT OF EQUITY AND ASSETS IN AND OUT OF CHAIN

LOAN AGGREGATION MACHINE

AMM TOGETHER ON VARIOUS CHAINS

INVESTMENT INTELLIGENCE

AND MANY MORE WILL BE RELEASE IN THE FUTURE AND FREE TO $ RAIN COMMUNITY MEMBERS.

Oracle Analytics Off-Chain aggregation for On-Chain Trust on Binance Smart Chain Rain.Credit leverages the power of Oracle off-chain analytics to provide an on-chain protocol with trust data, combined with a lending platform. allows you to safely maximize lending while gaining access to additional digital assets.

PROTOCOL ORACLE ANALYTICS FEED ON-CHAIN OFF-CHAIN.

Previous migration flights via DeFi are stored in your Ethereum address history. Rain.Credit’s off-chain oracle analysis accesses that history to provide the loan platform with more information about loan applicants to reduce the risk of default.

Oracles provide solutions to transparency problems that face many defi projects. By releasing chain information and supplying data in an unchanging manner, Rain.Credit Oracle enables smart contracts to pull data from blocks containing the information needed. the information that Rain.Credit oracle sends will include things that the blockchain cannot track or monitor. This includes payment history of users across multiple chains, real world economic events, government policy changes, and user account history.

Some examples of real-world events that can affect access to on-chain loans and increase the risk of default include, but are not limited to:

CUSTOMER ACCOUNT ACTIVITY

PAYMENT HISTORY

NEW GOVERNMENT POLICY

LOAN MORE ASSETS FOR LESS ASSETS

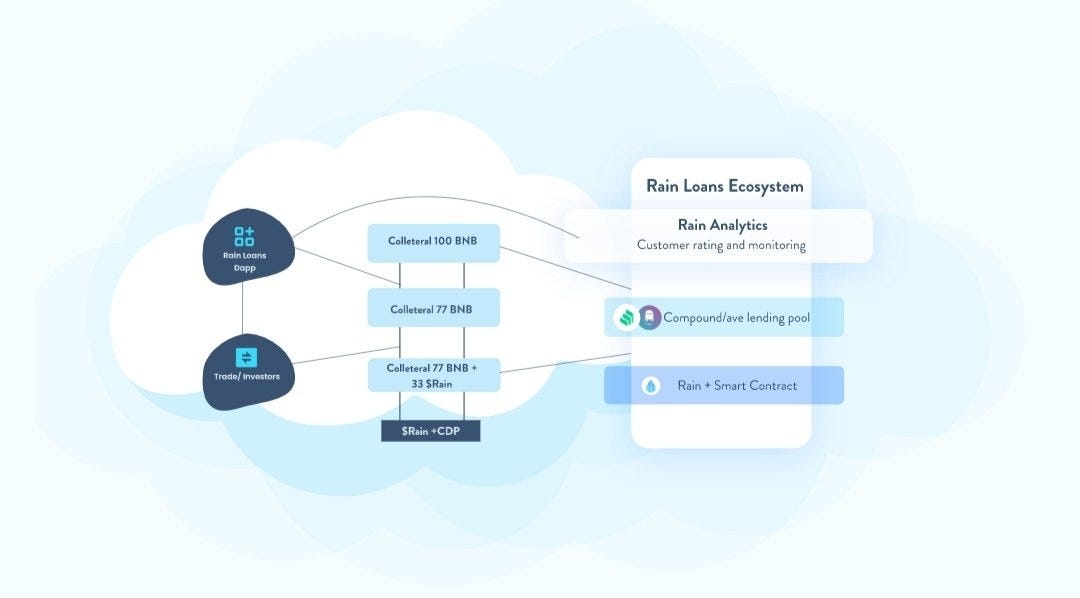

RAIN LOANS is a non-custodial digital asset lending and lending platform.it is based on a combined protocol with a modified asset pool and the use of Rain + to increase access to additional funds on top of the current secured debt position (CDP) offered by Compound Finance, AAVE & CREAM.

RAIN + IS the number of additional tokens we offer to borrowers through our platform without providing additional guarantees, based on their transaction history and ratings from Rain Off-Chain oracle analytics.

TOKENOMICS

$ RAIN has a simple distribution model. its total supply consists of 800,000 $ RAIN.

40% will be sold through presale

20% will be used for project development

20% will be used to provide liquidity and agricultural products

10% tokens will be allocated to the team (For 2 years, these tokens will be locked to instill trust in the community)

10% will be used for marketing

RAINBUILDER / MAIN DEVELOPER

Blockchain Engineer, Researcher, Developer with more than 10 years of combined experience in FinTech, Machinge Learning, Data Science, and the Blockchain Industry.

REGARDS / DEVELOPERS

Full stack engineer with more than 5 years experience in the blockchain industry. he is also very fluent in Rust, Python & Golang.

DRIZZLE / COMMUNITY MANAGER

Over 3 years experience in crypto, 5 years in customer relations, public relations and presentation skills, great interpersonal and relationship skills.

MONSOON / UI / UX DESIGNER

Fans of decentralized technology. Good Design, Technology and Innovation from Love.

For more information about RAIN.CREDIT, click the link beloW

WEBSITE: https://rain.credit/

TWITTER: https://twitter.com/rain_credit

TELEGRAM: https://t.me/joinchat/UqEl0GyJZ4WkDUWR

MEDIUM: https://rain-credit.medium.com/

DISCORD: https://discord.gg/aEc7NWbU

Author:

Username: balpointAE7

Wallet bnb20

bnb17mxdpuf6n5hhmnrx4ea4hwq9xl2gr40wt46le6

Komentar

Posting Komentar